Trump at The Bitcoin Conference, Mt. Gox Saga Continues & Interest Rate Decisions

You can now listen to a summary of this week's Weekly Wrap on Spotify and Apple Podcasts. It is a summary with the help of AI-voices.

What Happened This Week

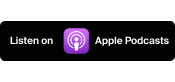

Last weekend, Donald Trump’s long-anticipated Bitcoin Conference speech took place, and former President Trump did not disappoint. He promised to fire current SEC Chairman Gary Gensler on his first day of presidency. He said that he intends to prevent the U.S. from liquidating its Bitcoin holdings and announced plans to build a strategic Bitcoin reserve. Furthermore, he compared the cryptocurrency sector with the steel industry from 100 years ago and mentioned that he believes crypto will eventually overtake gold. Overall, he presented a very positive speech on crypto and Bitcoin. When looking at Bitcoin’s price action, we observe a price buildup until Trump’s speech on Saturday evening our time and then a rather classic “sell the news” occurrence with the price of BTC correcting 3.5% to the downside after Trump’s speech.

Donald Trump was not the only U.S. politician to take the stage in Nashville at the conference, U.S. Senator Cynthia Lummis announced her plans to introduce legislation calling for a strategic bitcoin reserve. Her legislation proposes that the U.S. buy 1 million of Bitcoin over the course of five years in order to reduce the national debt.

When looking at digital asset investment products, the previous week saw inflows of $245 million. While Bitcoin saw inflows of over $500 million, Ethereum saw net outflows of $285 million, mainly due to the outflows from Grayscale’s ETHE product. Switzerland is once again ranked second after the U.S. with $40 million of inflows.

Bitcoin’s Weekly High on Monday

As mentioned before, Bitcoin saw a steady price increase up until Donald Trump’s speech on Saturday evening. After a small correction during Saturday night, Bitcoin climbed up to just slightly above $70’000 on Monday morning before starting its downward move on Monday afternoon around the time of the open of the U.S. stock market. While U.S. equities remained stable on Monday, Bitcoin fell by more than -5% on Monday, trading below $66’000. The correction on Monday evening was accompanied by the news that the U.S. government moved almost 30’000 BTC, connected to the confiscated Silk Road funds. A coincidence? Just two days after Donald Trump said he would make sure that the U.S. government would not sell its Bitcoin holdings. We will never know, the market reacted directly to the news, dropping by more than 2% within an hour.

An Update on The Mt. Gox Repayments

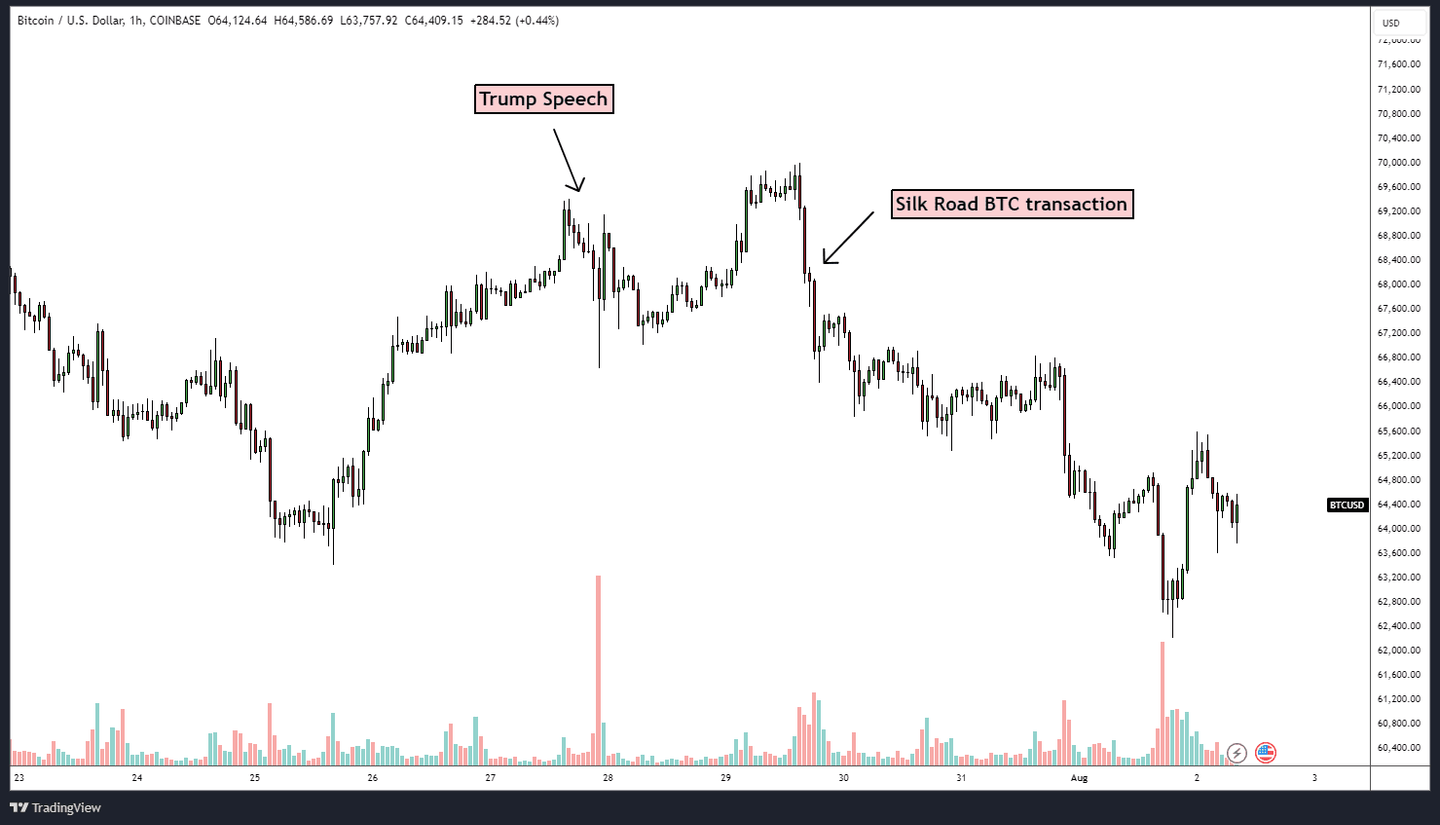

The repayments from Mt. Gox were a hot topic again this week. It started on Tuesday with a couple of test transactions and accelerated on Wednesday when a Mt. Gox address moved roughly 34’000 BTC to addresses belonging to the crypto custodian BitGo, according to Arkham. BitGo seems to be the fifth and final custodian, working with the Mt. Gox trustee to return BTC and BCH to creditors. Mt. Gox communicated on July 31, that they have now made repayments to over 17’000 rehabilitation creditors to date. According to Arkham, the Mt. Gox wallets now hold a total of 33’000 BTC, down from over 140’000 BTC at the beginning of July. You can track it here.

Bank of Japan: Second Interest Rate Hike Since 2007, Fed: Rates Unchanged

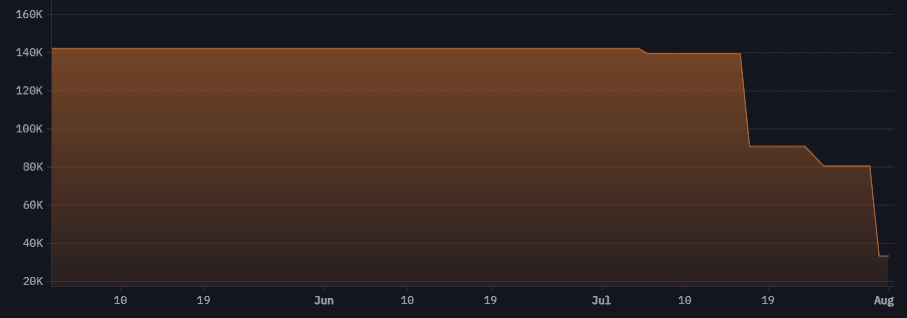

The Bank of Japan raised its interest rate to 0.25% and decided to slow the pace of its government bond buying to 3 trillion yen ($20 billion), in a further shift toward policy normalization as the nation battles a weakening yen. This move came a couple of hours before the U.S. Federal Reserve’s interest rate decision on Wednesday evening, where the Fed announced that it will maintain the interest rate at the current level of 5.25-5.5%, which was in line with market expectations.

While the Federal Reserve did not yet go for an interest rate cut, Chairman Jerome Powell said that such a cut was on the table for September, provided that the inflation data continues its way to the downside. Powell also emphasized that a cut in September would, of course, be apolitical and that the Fed never uses its tools to support political campaigns.

When looking at the expectations for the September meeting, target rate probabilities show that market participants are expecting rate cuts, with 70.5% expecting a cut of 25 bps and 29.5% expecting a rate cut of 50 bps, as seen in the chart below.

The Bank of England announced its first interest rate cut in more than four years on Thursday. This rate cut came as a bit of a surprise to many market participants, as only 61% expected a rate cut of 25 bps. The BOE reduced the interest rate to 5%, down from 5.25%.

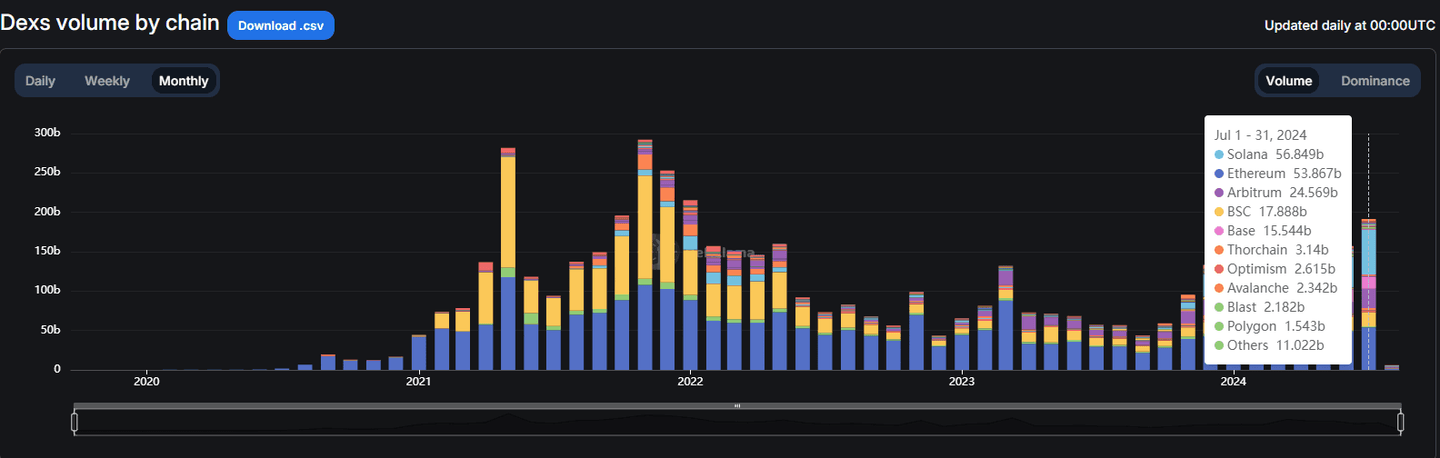

Solana Surpassed Ethereum in Monthly DEX Trading Volume

In July, Solana surpassed Ethereum in monthly DEX trading volume for the first time, reaching a monthly volume of more than $56 billion, compared to Ethereum’s $53 billion. Total trading volumes on DEXs for July are still lower than in March and April of this year. The current all-time high in DEX trading volume was in November 2021, when BSC was in first place with $130 billion, followed by Ethereum with $100 billion. Up until today, there were only a couple of months in which Ethereum was not in first place when it comes to DEX trading volume, in 2021, BSC took first place a couple of times, and now in July, SOL was in the top spot for the first time.

MicroStrategy To Raise Another $2 Billion to Buy Bitcoin

While MicroStrategy reported a Q2 net loss of $100 million, it also announced that it now holds a total of 226’500 BTC with an average purchase price of $36’821 and that they have acquired a total of 12’222 BTC since the beginning of Q2 for a total of $805 million. MicroStrategy further announced that they are intending to raise another $2 billion to buy more Bitcoin.

ETF Flows This Week

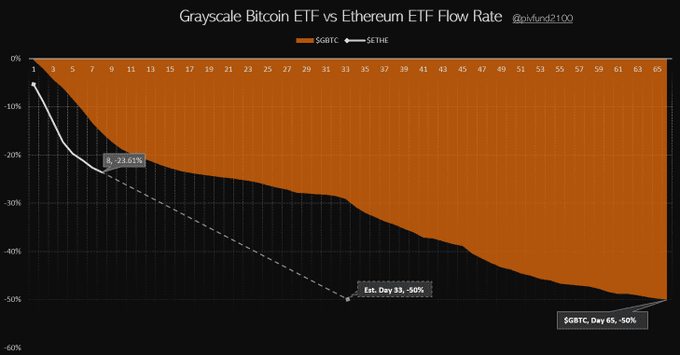

The Bitcoin spot ETFs saw moderate inflows this week, with Tuesday being the only day with net outflows so far. On Monday the BTC spot ETFs saw $124 million inflows, followed by $18 million in outflows on Tuesday. It has been a rather quiet week so far for the Bitcoin products. While the flows for the Ethereum spot ETFs overall are still in the negative, they recorded two days of net inflows this week, with $33.7 million inflows on Tuesday and $26.7 million inflows on Thursday. The outflows from Grayscale’s ETHE recorded their lowest level yesterday, with $78 million outflows. After 8 trading days, roughly 24% have exited the ETHE product. According to the chart below, if they continue in this fashion, the 50% mark might be reached as early as September 4, 2024.

This Week’s Price Action

The S&P 500 and the Nasdaq have experienced quite a wild week so far. After a slow Monday, both indices traded to the downside on Tuesday before opening higher on Wednesday and rallying into the FOMC press conference on Wednesday evening. Thursday was yet another down day, with the S&P reaching Tuesday’s low yet again, closing the day at the 5’446 level. At the time of writing, U.S. pre-market data shows a continued decline in the early trading hours for U.S. equities.

While the U.S. Dollar Index has traded sideways this week, Gold has been on a tear, currently up almost 6% for the week, likely due to the news regarding the conflict in the Middle East with Israel killing the Hamas political chief Ismail Haniyeh this week.

NVIDIA experienced a rollercoaster ride this week: It saw an intraday increase of more than 15% on Wednesday and then corrected roughly 10% to the downside on Thursday, while META is currently up almost 6% for the week after the announcement of an Q2 earnings beat on Wednesday evening.

The total crypto market cap is currently down more than 5% for the week, with many altcoins like AVAX, SOL, TIA or DOGE recording weekly declines of 5-15% so far. MicroStrategy is currently down more than 17% on the week, and Coinbase is down 15% respectively. A red week for crypto so far.

Our Take

Donald Trump’s positive remarks on Bitcoin were not able to push crypto prices higher this week, as market participants used his speech to sell the news after hyping his speech up for a couple of days during the previous week. This week was once again accompanied by Mt. Gox repayments, and the U.S. government spooked the market on Monday with the transfer of funds related to Silk Road.

While the outflows from ETHE appear to be slowing down, the Ether spot ETFs are not yet recording large inflows, and the Bitcoin products show moderate inflows for this week so far.

The Federal Reserve kept its interest rate unchanged, and U.S. equities traded sideways, possibly forming a bottom structure after trading to the downside since mid-July.

The crypto market overall experienced a red week, with altcoins like SOL being down more than 10% for the week and memecoins like WIF being down more than 20% this week alone. While Bitcoin is holding up relatively well compared to the altcoins, market sentiment on social platforms like X is low, as many market participants seem to be exposed to altcoins.

The Week Ahead

Monday, 5 August 2024

- EUR – PPI

Tuesday, 6 August 2024

- CH – Unemployment Rate

Thursday, 8 August 2024

-

U.S. – Initial Jobless Claims

-

Germany - CPI