Dominic WeibelHead of Research, Bitcoin Suisse

The Weekly Wrap: Ethereum’s Merge, U.S. August CPI

16/09/2022

1. Ethereum ships Merge without hiccups

The Facts:

- On Thursday, Ethereum successfully transitioned to Proof-of-Stake (PoS) in a flawless fashion as the Merge block proposed in Slot 4’700’013 and finalized in epoch 146’876.

- The Merge passed without hiccups, marking the successful conclusion of a multiyear effort mitigating technical and operational risk of upgrading a +$170b network in open-source development.

- The impressive participation rate (way above the mandatory 66%) led to the quick justification of the first epoch and the network subsequently reached finality by hitting two justified consecutive epochs.

- On Thursday afternoon, a couple hours after the Merge, the mainnet of the PoW fork went live as well.

- Coming next, the Shanghai upgrade, a couple months down the road, will unlock staked ETH before the Surge, a scalability upgrade introducing sharding, will be implemented.

Why it’s important:

- The Merge of the execution and consensus layer, that was previously described as trying to hot swap airplane engines in-flight, was completed smoothly after a marathon of testing and preparation without most users even noticing thanks to an impressive, multiyear effort by developers, researchers and coordinators.

- With the transition to PoS, a 99.8% reduction in energy consumption is achieved as neither expensive mining hardware nor operational cost of miners have to be compensated any longer by protocol emissions.

- This is not only accompanied by a ~90% decrease in protocol issuance but according to Ethereum researcher Justin Drake, also leads to a 0.2% reduction of global electricity consumption, similar to Finland just shutting off their power grid.

- This will not only establish improved sustainability of the network, but it will likely also lower the entry barrier for institutional investors, who struggled with ESG related concerns about the carbon footprint.

- As the first PoS block mined faced high demand due to MEV and squeezing in transactions for historical reasons, the block reward went up as high as 45 ETH.

- Following the Merge, SEC’s Chairman Gary Gensler did not hesitate to signal that Ethereum’s new PoS mechanism might draw attention of the SEC as staking could trigger securities laws.

- Moreover, voices grew louder around staking providers, as e.g. Martin Köppelmann pointed out that 420 of the first 1’000 blocks were built by Lido and Coinbase alone followed up by discussions that Lido is based on 28 independent operators.

- Regarding the PoW fork, Tarun Chitra revealed on the Chopping Block, that EthereumPoW discussed in their Discord to retarget burned funds from EIP1559, funds within the deposit contract and funds from the Ethereum Foundation to themselves; ETHW declined significantly in price following the mainnet launch and is currently trading at $13.22

2. U.S. inflation not yet slowing down enough despite tight monetary policy

The Facts:

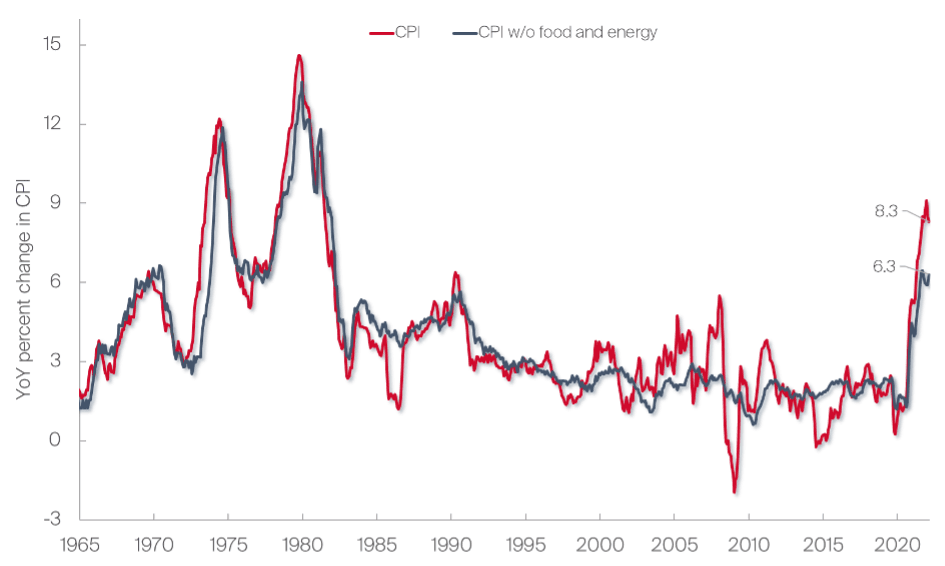

- The YoY U.S. CPI of August came down to 8.3%, slightly above the estimate of 8.1% and 0.2% lower than previous month’s rise of 8.5%, as energy costs and especially gas slumped further.

- Sticky core U.S. CPI, excluding food and energy, surprisingly rose to 6.3% YoY in August (estimated at 6.1%), 0.4% higher than previous month’s YoY core CPI.

- MoM U.S. CPI in August came in at 0.1% (estimated at -0.1%) while core MoM U.S. CPI rose to 0.6% (estimated at 0.3%) up 0.3% from previous month.

- While energy prices significantly eased, primarily rent, food and healthcare accounted for the reported CPI.

- The dollar showed strength - lifting relative spending power in the U.S. -while pushing down gold.

- Meanwhile, Argentina was forced to hike rates by 550 bps to 75% after YoY inflation overshot to almost 80% on Thursday’s report.

Why it’s important:

- As the CPI of August came in hotter than anticipated, the odds of a big rate hike at the FED’s next meeting next week have now increased even further as the market now prices in a 75 bps rate hike and even considers 100 bps to be reasonable.

- Moreover, the 2-year Treasury yield climbed to 3.9% on Friday, a level not seen since 2007 while the Labor Department on Thursday reported that unemployment claims decreased for the fifth week in a row indicating a surprisingly strong labor market.

- The dollar might hit its best year since 1984 implying more pain for almost every other currency that lose value while the dollar gets more attractive and forces other countries to hike rates as well.

In other news

- CeFi platform Celsius seeks to return $50m to custody clients (via CoinDesk)

- Michael Saylor accused of tax evasion (via Financial Times)

- Crypto casino Stake.com sued for $400m (via Bitcoinist)

- Decentralized NFT marketplace Sudoswap confims airdrop (via Twitter)

- Crypto.com backs out of $495m UEFA CL sponsorship (via SportBusiness)

- Mt. Gox claims approaches final steps before repaying creditors (Cointelegraph)

- Iran approves crypto for imports and trade (via Bitcoin.com)

31.3 ETH and 36 ETH

Amount of fees paid to mint the last PoW NFT and first PoS NFT, respectively, around the Ethereum Merge happening on Thursday

Source: (Data) U.S. Bureau of Labor Statistics, (Chart) Bitcoin Suisse Research

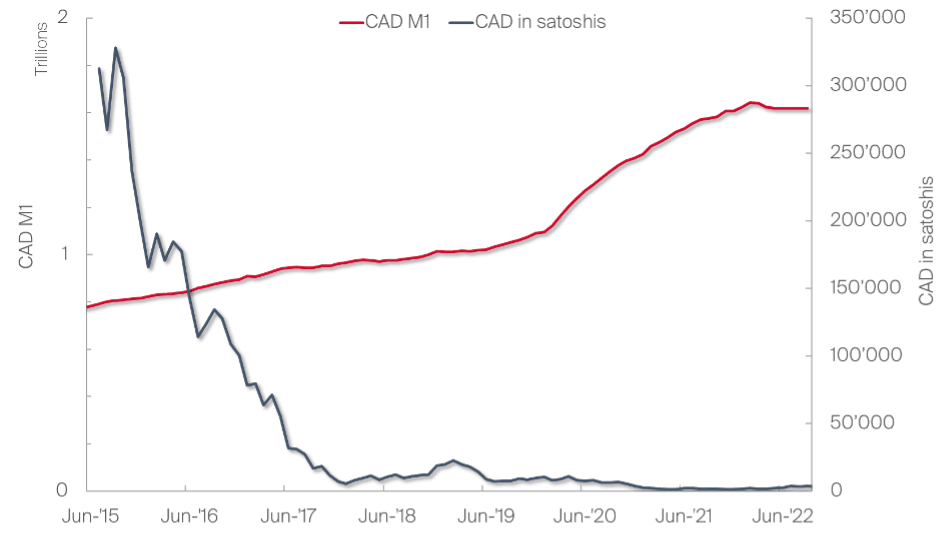

Telling people they can opt out of inflation by investing in cryptocurrencies is not responsible leadership.

Justin Trudeau, 23rd Prime Minister of Canada, on crypto investing after Canada inflated M1 money supply by 5.7x within the last 20 years. (via Twitter)

Source: (Data) FRED, Tradingview, (Chart) Bitcoin Suisse Research